Elo’s investments perform well in 2016 carbon footprint review

The carbon intensity of Elo’s equity investments was below the equity market’s average. The carbon sink of forest investments partly compensates for the equity investments’ footprint. The review now covers nearly half of Elo's investment assets.

Elo calculated the carbon footprint of its investment assets for the second time. Last year Elo was the first in Finland to calculate the carbon footprint covering direct equity investments, corporate bonds and real estate investments.

“We expanded our review to include all equity investments and took into account the positive impact of the forest investments’ carbon sink. The review already covers nearly half of Elo's current investments,” says Kirsi Keskitalo, Responsible Investing Specialist at Elo.

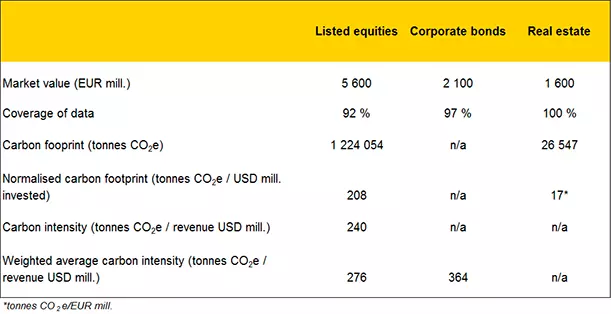

Carbon footprint calculations of Elo’s investments for 2016

The carbon intensity of Elo’s listed equities was 240 (tCO2/MUSD), which is lower than the benchmark. The weighted average carbon intensity of Elo’s corporate bond portfolio was 364 (tCO2/MUSD).

“Due to change in allocations in the portfolio, the year on year comparison does not provide a sufficient picture of the development of carbon intensity. In the long term, it would be important to monitor the trend to be sure that it is moving in the right direction,” Keskitalo says.

The carbon intensity of Elo’s direct real estate investments was 17 (tCO2/MEUR), which is lower than a year ago. The weather-adjusted trend is falling in terms of both heat and electricity consumption. The forest investments’ carbon sink was 117 000 tCO2 in 2016 which compensated roughly 10 % of our equity investments’ carbon footprint. The total carbon sink of the forests owned by Elo is approximately 2 500 000 tCO2.

Carbon intensity is sensitive to changes in allocation and market valuation

“It is important to notice that the carbon intensity is very dependent on changes in a portfolio allocation and market valuation, making it very sensitive to substantial year on year changes,” Keskitalo says.

In European equity markets, companies’ carbon intensity increased by 35 % in 2016 due to the increase in the valuation of carbon-intensive companies in the basic industries and energy sectors. The return on Elo’s European equity investments was significantly better than the market average while the carbon intensity remained well under control.

Elo encourages companies to report on their environmental impact

“It is also important to understand that in many emerging markets environmental reporting has barely started. In China, for example, only 3 % of companies report their greenhouse-gas emissions.

“Elo has signed CDP and therefore encourages companies to report their impact on environment and to pay attention to their carbon risk,” says Keskitalo.

Elo is committed to taking into account carbon risk in its investments

Elo has signed the Montréal Pledge and therefore is committed to taking into account the carbon risk in its investments. The carbon footprint is measured annually and we incorporate the results in our investment analysis. Measuring the carbon footprint helps investors to understand better the environment related risks and opportunities.

“However, it is important to realise that the carbon footprint alone is not a sufficient indicator to evaluate the investment asset’s climate risk. In addition other factors must be taken into account such as fossil fuels in the balance sheet, the company’s dependency on fossil fuels, changes in its business operations and its goals concerning climate risk,” Keskitalo says.

Table showing Elo’s carbon footprint calculations:

Further information:

Kirsi Keskitalo, Responsible Investing Specialist, tel. +358 20 703 5728

Kirsi.keskitalo@elo.fi