Elo Pension Insurance Company clearly reduced the carbon footprint of its investments

In 2017, the carbon footprint of Elo’s listed equity investments decreased by 25%. The carbon intensity of the equity investments was 15% below the benchmark index. Within direct equity and corporate bond investments, already one third of the companies are delivering sustainable development solutions.

“In 2017, we managed to reduce the carbon risk across all asset categories while at the same time achieving the best return on investments in the history of Elo,” explains Jonna Ryhänen, Director for the Securities Division at Elo.

Elo’s objective is to ensure sustainable returns for our investments in order to secure the pension assets, taking into account the challenges that climate change imposes on the financial markets and our investments.

The carbon footprint represents the climate load of companies, in other words, the quantity of greenhouse-gas emissions resulting from their business operations. Carbon intensity is obtained by calculating the carbon footprint in relation to the company size. This facilitates the carbon footprint comparison between companies of various sizes.

“During the past year, we cut down our investments in carbon-intensive companies. The carbon intensity of our equity portfolio decreased in all geographical regions, but especially in the emerging markets and in the USA. Globally, the strong growth of the stock markets also decreased the carbon footprint because of its reducing effect on company-specific carbon footprint values,” says Ryhänen.

"However, when evaluating the investments, it is important not only to consider the carbon footprint of a particular company but also the company’s fossil fuel assets, its operational dependency on fossil fuels, and the changes and goals of its business operations,” Ryhänen continues.

Tackling climate change through positive impacts

In 2017, a total of 34% of the companies included in Elo’s direct equity and corporate bond investment portfolio delivered sustainable development solutions with a positive impact on the environment or society. In 2016, the corresponding figures were 24% for equity investments and 22% for corporate bond investments. Within infrastructure and real asset investments, already 44% of the investments in the portfolio delivered solutions with a positive impact. Elo’s aim is that, by 2025, more than half of the investments in these asset categories would deliver solutions with a positive impact.

“For example, the positive environmental impact of Elo’s forest investments as a result of the annual growth of forests, also known as the carbon sink, increased in 2017 by nearly 50 percent over the previous year, and the carbon sink related to the forests owned by Elo compensated for about 14 per cent of the carbon footprint of all our equity investments,” says Kirsi Keskitalo, Head of Responsible Investment at Elo.

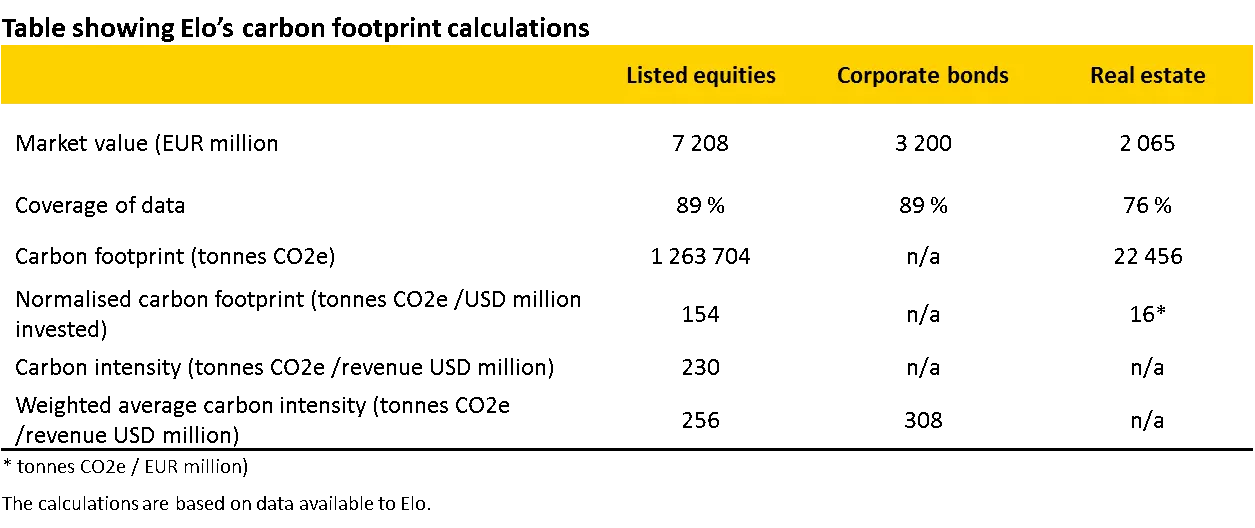

Reduced carbon footprint across all asset classes

In 2017, the carbon footprint of Elo’s listed equity investments decreased by 25% as compared to the preceding year. The carbon intensity of equity investments was 230 (tCO2/MUSD), which is 15% below the benchmark index. The carbon intensity was lower than the index in all geographical regions. The carbon intensity decreased by 4% from the year 2016. The carbon intensity of Elo’s corporate bond portfolio decreased by 15% as compared to the previous year. For the corporate bond portfolio, the carbon footprint review was expanded in 2017 to include fund investments in addition to direct investments. The carbon footprint of Elo’s direct real estate investments decreased by 6% over the previous year.

Elo’s carbon footprint review already covers nearly half of its total investment assets of EUR23.1 billion. The review covers all listed equity investments, including passive index investments. For corporate bonds, the review in 2017 included corporate bond fund investments as well.

More information: Kirsi Keskitalo, Head of Responsible Investment tel. +358 20 703 5728 and

Jonna Ryhänen, Director, Securities, tel. +358 20 703 5707