TyEL insurance contributions in 2026

TyEL contributions in 2026

The size of the TyEL contribution primarily depends on whether you operate as a contract employer or an occasional employer.

The contract employer's TyEL contribution is customer-specific and consists of several different components.

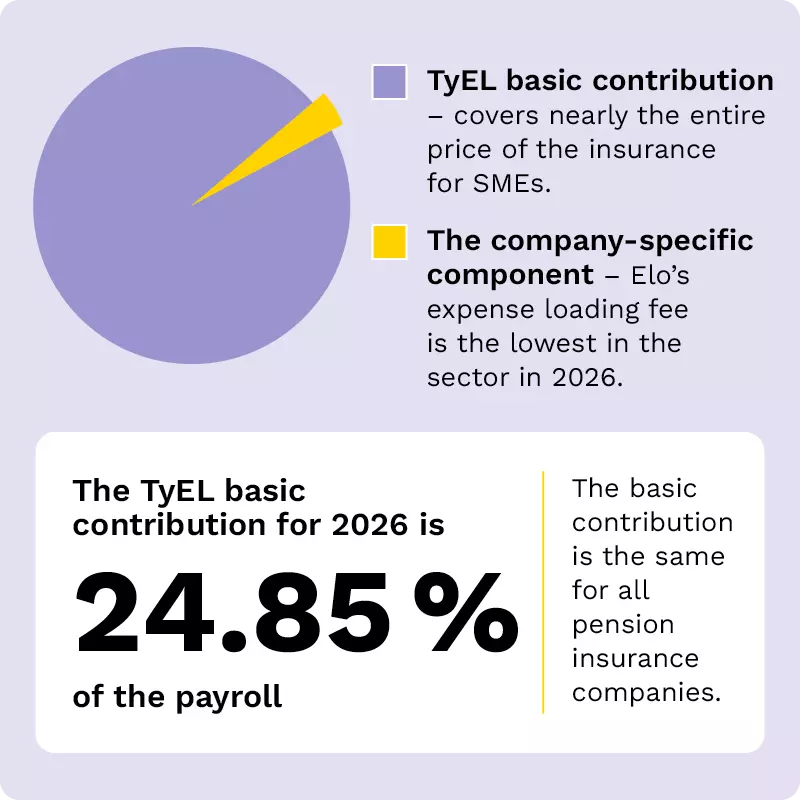

- The largest part is the TyEL basic contribution, which is the same across all pension insurance companies: 24.85 % of wages in 2026 (25.28 % in 2025).

- In addition, a small portion of the contribution is an expense loading fee, which is based on the pension companies’ own calculation principles. Elo’s expense loading fee is reduced by constancy and large-scale company discounts.

- The final TyEL contribution is also lowered by any potential client bonus, which is applied as a one-time adjustment in the TyEL invoice in spring 2026.

If the payroll of your company exceeded 2,229,000 euro in 2025, you are considered a large-scale employer.

TyEL 2026: What does the contribution consist of?

The TyEL contribution for companies is comprised of the basic contribution and a company-specific component. The basic contribution is the same for all pension insurance companies and it constitutes the majority of the TyEL contribution. The Ministry of Social Affairs and Health (STM) confirms the basic contribution annually.

The expense loading fee is a component that is added to the basic contribution; with it, each pension insurance company covers the operating expenses accrued from managing insurance policies.

Constancy discount Elo's own way of rewarding long-term customers annually after the third year of customership.

Large-scale company discount If the payroll insured at Elo was a minimum of 2,229,000 euro in 2025, the employer is entitled to Elo's large-scale company discount.

Client bonus A share of the pension insurance company's result that is transferred to the customer. Its size is impacted by the pension insurance company’s solvency and the duration of the customer relationship.

Read more about how the TyEL contribution is formed and its components

The temporary employer's TyEL contribution in 2026 is 25.85 % (26.28 % in 2025).

The employee’s share of the contribution in 2026 is 7.30 % for employees of all ages.

Check the TyEL contribution details for contract employers in our online service

In our online service, you can view:

- the current year's TyEL contribution rate from earnings reports in mid-January. For large employers, the rate may vary during the year due to the impact of the contribution category.

- the development of contributions, found under the Insurance Information tab.

- an estimated calculation showing the projected TyEL contributions for the entire year.

- the final TyEL insurance contribution and rate for the whole year once the last earnings report has been submitted.

- contribution categories for large employers.

- the status of invoicing, including both open and paid TyEL contributions.

You can also get an estimate of next year’s TyEL contribution rate, total contribution, and its components by using the contribution estimate calculator in the online service.

Log in to the online service and check your contribution estimate

An Elo customer relationship pays off in 2026 as well

We have streamlined our operations, and Elo’s expense loading fee has once again decreased. The expense loading fee is part of the TyEL contribution and varies between pension insurance companies. Starting January 1, 2026, our average expense loading fee will be the lowest in the entire earnings-related pension sector. We will continue to improve our operations, and our customers will benefit from our efficiency in the years to come.

Constancy discount reduces the administrative fee

We remain the only pension insurance company to reward long-term customers with a Constancy discount. As our customer, you will receive this discount when your TyEL insurance has been with us for three consecutive years, with earnings reported to the Incomes Register each year, and the insurance has not been transferred to another pension insurance company during that time. The discount is automatically applied to your TyEL contribution and requires no action from you.

Elo supports your business

We make managing insurance and pension matters clear and effortless, so you have more time for your core business. With your insurance contribution, you gain access to Elo’s extensive expertise in earnings-related pension insurance, supporting you in retirement, vocational rehabilitation, managing work ability risks, and all insurance-related matters. Both corporate and individual customers can use our online services for smooth, fast, and secure transactions.

During service hours, we answer your call in under 2 minutes and resolve your matter on the first call in up to 93% of cases.