TyEL contributions and certificates

As an employer, you take care of employees’ pension security by paying TyEL contributions to the employment pension company. The TyEL contribution is determined in the same way in all pension insurance companies according to the criteria ratified by the Ministry of Social Affairs and Health and is a specific percentage of the employee’s gross earnings.

As an employer, you take care of employees’ pension security by paying TyEL contributions to the employment pension company. The TyEL contribution is determined in the same way in all pension insurance companies according to the criteria ratified by the Ministry of Social Affairs and Health and is a specific percentage of the employee’s gross earnings.

TyEL contribution for 2025

For a contract employer the TyEL basic contribution for 2025 is 25.28 % of the TyEL payroll. Elo’s basic expense loading fee is added to the TyEL basic contribution. The insurance contribution is reduced by a possible client bonus. The TyEL contribution is calculated from the payroll data reported to the Incomes Register. The employment pension company invoices the whole contribution from the employer, who in turn will deduct the employee share of the contribution from each employee’s wages or salary.

In 2025, the employee’s share of the contribution is:

• 7.15 % for those under 53 years of age,

• 8.65 % for those aged 53–62 years and

• 7.15 % for those who have turned 63.

If your company’s payroll sum was over EUR 2,337,000 in 2023, you are considered a large-scale employer.

For an occasional employer the contribution is 26,28 %.

Do you need TyEL contribution estimation for 2025?

Our TyEL-contribution estimate shows an estimate of the entire current year's TyEL contribution, an estimate of the year's TyEL contribution percentage and the employees' contribution share, a client bonus and Elo’s expense loading fee together with the possible discounts.

The next year's TyEL-contribution estimate is always available at the end of the current year.

Log in to Online Service and check out the contribution estimation

Do you need a TyEL certificate?

Brochures on contributions

Do you need a payment extension for your invoice?

If you are unable to pay your TyEL invoice before the due date, we highly recommend you to request a payment extension in advance.

- As long as you have submitted your Incomes Register reports on time and applied for a payment extension for your TyEL invoice before the due date, you can get a one-month extension at the insurance contribution interest rate of 2,65%, which is valid between 1 January–30 June 2025.

- If you apply for a payment extension after the due date or need a longer extension, we will charge the standard statutory penalty interest rate, which is 11.50% between 1 January–31 December 2025.

- Another reason why it is wise to ask for a payment request in advance is that we charge an additional 10 euro for every TyEL invoice reminder we send.

- The most convenient way to apply for the payment extension is through Elo’s Online Service.

TyEL contribution payment methods

You can pay TyEL contributions in two ways:

1. Monthly invoice

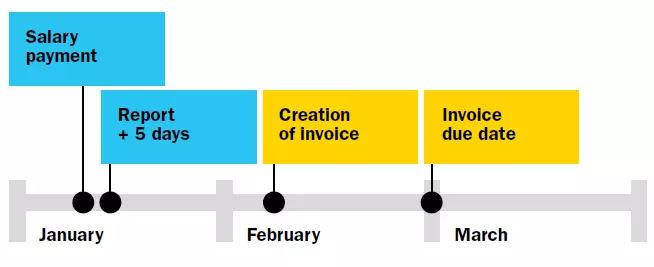

You will receive an invoice once a month for all reports of the same salary payment month. Even if you paid salaries three times a month, for example, the information of all three salary payments is compiled into a single invoice.

2. Invoice for each payroll report separately

You will receive an invoice for each payroll salary report separately. This means that you will receive as many invoices as you have salary payment reports.

The default payment method is automatically an invoice once a month, and you can change the payment method through Elo’s online service.

Due date of the TyEL contribution and insurance contribution interest

Take electronic invoices into use

We recommend that you take electronic invoices into use so that you can pay insurance contributions quickly and easily.

You can receive invoices electronically to:

• your company’s invoice handling system or web bank

• the e-mail address you have given or to

• Posti’s OmaPosti service.

In addition, private customers can receive an electronic invoice in their web bank.

Read more detailed instructions about taking electronic invoices into use