The contribution category model for large employers

For large employers, the amount of the TyEL contribution depends on the contribution category. The category is determined by the disability pension and partial disability pension costs arising from the company’s employees.

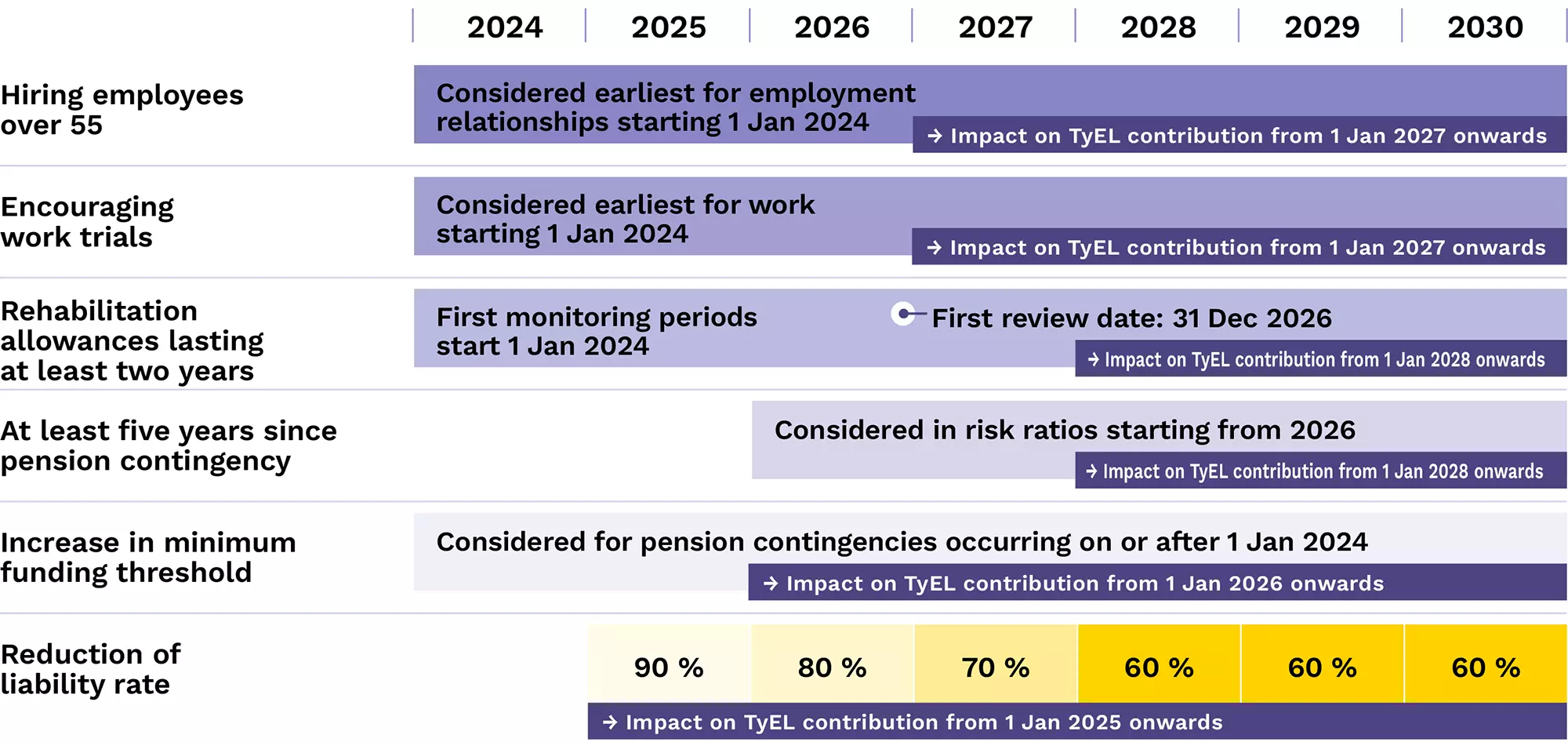

The amendments to the contribution category model under the Employees Pensions Act (TyEL) came into force on 1 January 2024. The aim of the reform is, among other things, to support the employment of people over 55 and those with partial work ability. The changes will gradually affect earnings-related pension contributions.

The reform encourages employers to anticipate work ability risks and take even better care of employees’ work ability.

Elo’s customers can find information about their company’s contribution category in the online service.

Changes to the contribution category model

Upcoming changes to the contribution category model

-

1. Hiring employees over 55

No contribution category impact for new employees hired at age 55 or older, even if the employee becomes disabled.

Effective: Applies to employment relationships starting on or after 1 January 2024.

Impact on TyEL contribution: earliest in 2027. -

2. Encouraging work trials, apprenticeship training and practical work training

If employment with a new employer begins as a work trial, apprenticeship training or practical work training as part of vocational rehabilitation, the employer receives a five-year protection period. During this time, disability does not affect the contribution category.

Effective: Applies to work trials starting on or after 1 January 2024.

Impact on TyEL contribution: earliest in 2027. -

3. Shorter delay for contribution category impact: rehabilitation allowances lasting at least two years

Rehabilitation allowances affect the contribution category when at least two years have passed since the start of the first allowance and the pension continues the following year. Rehabilitation allowance is not considered if vocational rehabilitation is ongoing or about to start at the time of review.

Effective: First considered in the risk ratio for 2026.

Impact on TyEL contribution: earliest in 2028. -

4. Cost cut-off: At least five years since pension contingency

Disability pensions or rehabilitation allowances are not considered in the contribution category calculation when at least five years have passed between the pension contingency year and the risk ratio year.

Effective: First excluded in the risk ratio for 2026.

Impact on TyEL contribution: earliest in 2028. -

5. Short employment relationships will affect contribution category even less frequently

No contribution category impact if the employee becomes disabled and the total wages paid during the two calendar years preceding the pension contingency are less than EUR 10,000 (2024 index).

Effective: Applies to pension contingencies on or after 1 January 2024.

Impact on TyEL contribution: earliest in 2026. -

6. Gradual reduction of liability rate

The liability rate will decrease by 10% annually, and by 2028 it will be 60% of the pre-reform level. As a result, even the largest employers will pay a pension contribution that is always affected by both their own contribution category and the basic category share.

Effective: Gradually from 2025 to 2028.

Impact on TyEL contribution: from 2025 onwards, applies to all large employers.