Payments and Paying

The TyEL contribution, or earnings-related pension contribution, is a certain percentage of the employee’s gross salary.

The TyEL contribution is calculated and paid monthly based on the earnings data reported to the Incomes Register. As an employer, you are responsible for paying it to the pension insurance company. The employee participates in the TyEL contribution according to their age with a share that you deduct when paying out their salary.

TyEL contribution in 2026

The amount of the TyEL contribution depends primarily on whether you operate as a contract employer or a temporary employer.

For contract employers, the TyEL contribution is customer-specific and consists of several parts.

The largest part is the basic TyEL contribution, which is the same in all pension insurance companies: 24,85 % in 2026 (25,28 year 2025). In addition, a small part of the contribution is a basic expense loading fee, which is based on the pension company’s own calculation principles. At Elo, factors such as constancy and large-scale company discounts reduce the administrative fee. The final TyEL contribution is also reduced by any possible client bonus.

If your company’s payroll exceeded €2,455,000 in 2024, you are considered a large-scale employer.

For temporary employers, the TyEL contribution in 2026 is 25,85 % (26,28 % year 2025).

The employee's contribution is 7.30% for all employees. (In 2025, 7.15% for those under 53, 8.65% for those aged 53–62, and 7.15% for those aged 63 and over.)

Read more about how the contribution is formed and its components

Estimate of TyEL contribution

As a contract insurance customer, you can make an estimate of the TyEL contribution in Elo’s company online service. The estimate shows the TyEL contribution and its components, which you can use for budgeting.

The estimate includes:

- TyEL contribution in euros for 2025

- TyEL contribution percentage and employee shares

- Client bonus

- Basic loading fee with possible discounts

The estimate for the next year is available towards the end of the current year.

Log in to the online service to make an estimate

If you are not yet an Elo customer, you can estimate the TyEL contribution using the wage calculator.

Payment due dates

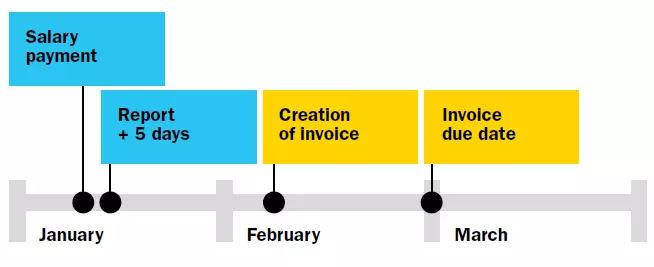

Employee earnings must be reported to the Incomes Register within 5 days of salary payment. If you report on time, the TyEL invoice due date is the last day of the month following the salary payment month. After that, insurance contribution interest is charged 2.65% from 1 Jan to 30 Jun and 2.10% from 1 Jul to 31 Dec 2025.

Payment extension

If you cannot pay the TyEL invoice by the due date, apply for an extension before the due date.

- If you apply before the due date and have reported earnings on time, you can get one month’s extension with insurance contribution interest 2,20 % Jan-Jun 2026.

- After the due date or for a longer extension, the statutory late payment interest applies: 10.50% Jan-Jun 2026.

Applying extension on time also avoids a €12 reminder fee. The easiest way to apply is through Elo’s company online service.

Log in to apply for payment time

Invoicing methods

You can choose how and how often you receive invoices.

Invoicing method:

- E-invoice to your company’s invoicing system or online bank

- Email invoice to the address you have provided

- Electronically to OmaPosti service

- On paper by mail

Private customers can also receive e-invoices in their online bank.

Read instructions for activating electronic invoicing

Invoicing frequency

You can also influence how often we send an invoice

1. Invoice once a month You receive one invoice once a month for all salary reports from the same salary month. Even if you pay salaries, for example, three times a month, the information from all three payrolls is compiled into one invoice. This is the default method, but you can change the payment method in Elo's company customer online service.

2. Invoice for each salary report separately. In this case, you will receive as many invoices as you have salary reports.

Certificates

With the TyEL payment certificate, you can demonstrate that your insurance is valid and the insurance payments are in order. You may need the certificate, for example, as an attachment to an offer to show that you have covered your employees with TyEL insurance.

As an Elo contract insurance customer, you can print the TyEL payment certificate in our online service.

Read more about the TyEL certificate

TyEL payment details in the online service

In the online service, you can see

Current year

- TyEL contribution percentage from mid-January (may vary for large-scale employers).

- Payment information under the Insurance Information tab.

- Contribution estimate for the whole year.

- Final TyEL contribution and percentage after the last earnings report.

- Large-scale employer contribution categories.

- Invoicing status (open and paid invoices).

Next year

- Estimated TyEL percentage, contribution, and components in Oct–Nov using the estimation tool.