Light entrepreneur – Do you need YEL insurance?

On this page

Who needs to get YEL insurance?

Your YEL income is at least 9,423.09 euros in 2026

Your YEL income should match the value of your work input in your company. It means the amount that would be paid to as skilled workers as you doing the same job.You are 18–68 years old

The obligation to insure starts from the beginning of the month after you turn 18 and continues until the end of the month when you turn 68. The upper age limit increases gradually:

- 68 years for those born in 1957 or earlier

- 69 years for those born in 1958–1961

- 70 years for those born in 1962 or later

You work in your company

Owning a company doesn’t automatically require YEL insurance. You only need it if you also work in the business. And if you work as an employee in another company, your employer will take care of your pension contributions under the Employees’ Pensions Act (TyEL).

When do you need to get YEL insurance?

As a light entrepreneur, invoicing service user or freelancer, you need YEL insurance if:

- Your YEL income is over 786 euros per month for at least four months, or at least 9,423.09 euros per year

- Your entrepreneurship lasts at least four months

- You work for yourself, without an employer

- You are 18–68 years old

- You live in Finland

You also need YEL insurance if you work as a light entrepreneur alongside paid employment, if the above conditions are met. Get YEL insurance within six months after you meet the requirements. If you get YEL insurance over six months late, you may have to pay an additional fee for the delay.

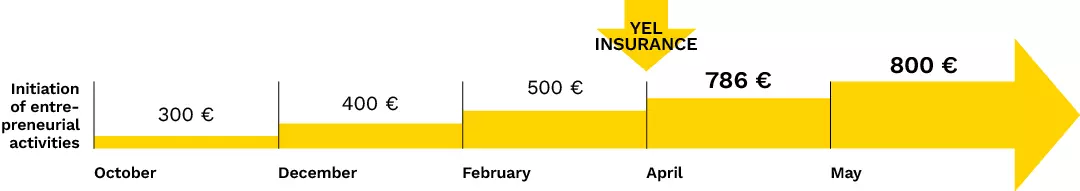

When your YEL income exceeds the limit of 786 € per month, you need YEL insurance. The figures below show the monthly income of a starting entrepreneur.

How much does YEL insurance cost?

The cost of YEL insurance depends on your YEL income.

These things affect the price:

- Your YEL income – You can join the unemployment fund if your YEL income is at least 15,481.00 euros per year in 2026.

- Discount for new entrepreneurs – You get a statutory 22% discount for the first 48 months.

- Payment method – The fee is lowest if you pay the whole year at once in January.

YEL insurance fees are tax-deductible. You can use Elo’s YEL calculator to estimate your YEL income and see the price.

Why choose Elo for your YEL insurance?

Elo is Finland’s most popular provider of entrepreneurs’ pension insurance.

About 40% of entrepreneurs have chosen Elo. Here’s why:

- You are important to us. We ensure you receive personal service the way you need.

- Fast service. You can manage insurance matters easily through our online service anytime. On the phone, we resolve 93% of issues in just one call.

We believe entrepreneurs are essential for Finland’s future. Whether your company is big or small, growing or stable, we will take care of your financial security now and in the future. We keep you up to date and explain things clearly. Let’s take care of your pension matters together so you can focus on your business.