On this page

Does your client need an occupational pension insurance?

Insurance effective immediately online

Log in to the electronic application and fill in the details. You will get the insurance effective immediately for your client and have access to the TyEL insurance number.

For the YEL application, the entrepreneur must log in to the service themselves for the time being.

Let us handle the insurance for you

Leave the insurance application process to us.

An Elo expert will contact the client, assess their situation, and confirm to you once the insurance is in place.

Call us or leave a callback request

You can also leave us a callback request.

Leave a callback request (in Finnish)

Do you need a power of attorney for Elo's online service?

In our online service, you can view information related to your client's TyEL and YEL insurances, such as payment details and employee salary information recorded from the income register.

Authorizing your accounting firm for your client's online service can be done by completing the electronic online service power of attorney.

You can fill out the power of attorney on behalf of the client. If the power of attorney is completed by someone other than the person with signing authority for the authorizing company, it will be sent via email to the person with signing authority for approval.

To start using the online service, you also need your own online service agreement for your accounting firm.

Why collaborate with Elo?

Versatile online services

You only need a power of attorney from the client for the online service and your own online service agreement for your company.

Expert customer service

We save your time by getting things sorted out immediately.

You receive support for your own work from us

We annually organize the highly popular Elokuvissa event, where we share current information packaged in an entertaining way.

Elo's services

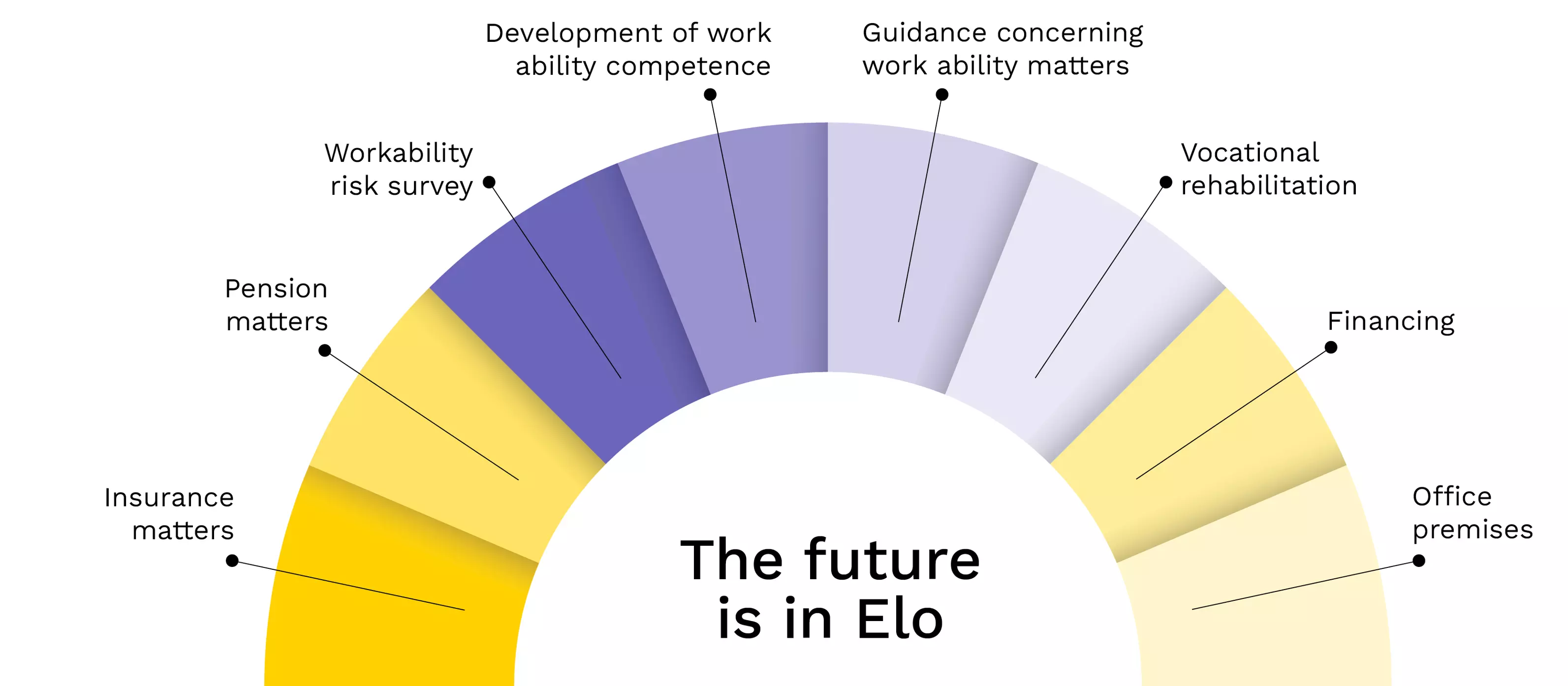

We offer a wide range of services for our TyEL clients. As our client, you receive all the services you need to keep your employees and company ready for the future: insurance and pension matters, work ability management services, vocational rehabilitation, as well as financing and premises.

Insurance contributions and client bonuses

You can conveniently view the confirmed insurance premium details and percentages for 2025 in the Social Insurance Contributions table (PDF).

Customer bonuses for TyEL insurances are calculated annually in March, and we send a message to our clients once the bonuses have been calculated. The bonuses are usually applied to the following TyEL invoices after the calculation.

On our website, you have access to calculators that help estimate both TyEL and YEL payments:

- With the YEL calculator you can check the insurance price for your client, examine the impact of earned income on social benefits, and compare the effects of different payment methods on the payment.

- With the Wage calculator, you can help the client estimate the total costs of hiring one or more employees.

Remember to check and correct salary information in the Income’s register

If Income’s register declarations need to be voided due to errors or omissions, it's important to note that all voiding declarations are transmitted to Elo and all other data users. Voiding can therefore affect employer payments, interest calculations, and other potential decisions by data users. To minimize the impact of voiding, it's advisable to void and submit a new declaration on the same day by 2 PM.

On our website, you can find answers to frequently asked questions about the Income’s register.

Our customer service is happy to assist you with issues related to declarations and corrections at 020 694 733.