Responsible investing is taking care of the future pensioners

The responsibility for pension funds extends over decades. We create life-long security and ensure that our customers receive their earnings-based pensions both now and in the future. Responsibility is an essential part of Elo’s strategy and values. Responsible investment is also underpinned by our broader societal mission – our responsibility to policyholders and the insured.

On this page

How do we invest responsibly?

We invest earnings-related pension funds profitably and securely in accordance with our strategy and operating principles. We ensure sufficient solvency in all market situations and manage pension assets cost-effectively and responsibly. By acting responsibly, we manage the risks associated with investments, achieve a good return, and identify societal changes and systemic risks.

We assess the sustainability of our investments from the perspective of environmental responsibility, social responsibility and good governance. We believe that the only way companies achieve long-term sustainable results is through sustainable business.

Our Principles for Responsible Investment guide the sustainability of our investment activities. The principles apply to all our investments, and when investing, we also take into account the specifics of each asset class and form of investment.

The areas of responsible investment are:

Elo's advocacy policy for investments describes the principles, practices and objectives of advocacy.

In matters related to climate change, our investment activities are guided by our climate policy for investments. We are committed to a carbon neutral investment portfolio in line with the goals of the Paris Agreement. In 2021, we joined the Net Zero Asset Owner Commitment for carbon neutrality under the Paris Aligned Investment Initiative (PAII). We have taken into account the commitments and objectives of the initiative in our climate policy.

We implement a carbon-neutral investment portfolio by

- reducing the carbon footprint

- increasing investments in sustainable solutions

- reducing the proportion of fossil fuel production in investments

- taking into account the risks and opportunities of climate change for the various asset classes and in our investment strategy and allocation work

- examining how aligned the objectives and strategies of our investees are with the objectives of the Paris Agreement and

- influencing businesses and other economic operators in line with our climate policy objectives

Learn more about our climate policy.

For investors, the loss of biodiversity is an economic systemic risk similar to climate change. Therefore, its effects should be identified. The profitable and secure investment of pension funds also requires that biodiversity is taken into account.

We have created a roadmap for taking biodiversity into account. The roadmap consists of four phases: familiarisation, analysis, integration and reporting. The stages run in parallel and require constant familiarisation, self-assessment and development.

We contribute to the achievement of the UN Sustainable Development Goals, and our goal is to increase investments in sustainable solutions. Sustainable solutions mean activities that aim to meet significant societal and ecological challenges. These include products and services related to areas such as energy efficiency, alternative energy, pollution reduction, healthcare, waste management, and education.

Our definition of the sustainability of our investments is based on national legislation as well as international standards on business operations, the environment, human rights and corruption. We expect investee companies to comply with the following international standards, among others:

- The UN Global Compact, based on UN declarations on human rights, the environment and corruption

- OECD Guidelines for Multinational Enterprises

- ILO labour conventions and recommendations

- United Nations Guiding Principles on Business and Human Rights (UNGP)

We monitor the activities of investee companies based on information provided by an external service provider and other analytics services, as well as public data sources. If we detect a breach in the company’s operations, we investigate the severity and extent of its effects and the company’s response to the shortcomings. We engage with the company either independently or in collaboration with other parties, or we monitor the situation through our service provider. The investment may be divested if the company does not take credible measures to remedy the breaches. In fund investments, the monitoring of any shortcomings and influencing their correction are mainly done by fund managers, with whom we engage in regular dialogue.

We have excluded certain sectors from our direct investments on ethical or climate-related grounds:

- tobacco manufacturers

- energy companies for which more than 15 percent of revenue is derived from coal production or the use of coal in energy generation, without a clear strategy to reduce coal use, or energy companies with new coal investments

- energy companies for which more than five percent of revenue is derived from oil sands extraction or from the production of Arctic oil or gas

- companies manufacturing anti-personnel landmines, cluster munitions, or nuclear weapons whose headquarters are not located in a NATO or EU member state

- companies manufacturing other controversial weapons (such as biological and chemical weapons)

We review the sovereign bond investment universe annually and exclude countries that perform weakly in terms of responsibility and show no foreseeable improvement.

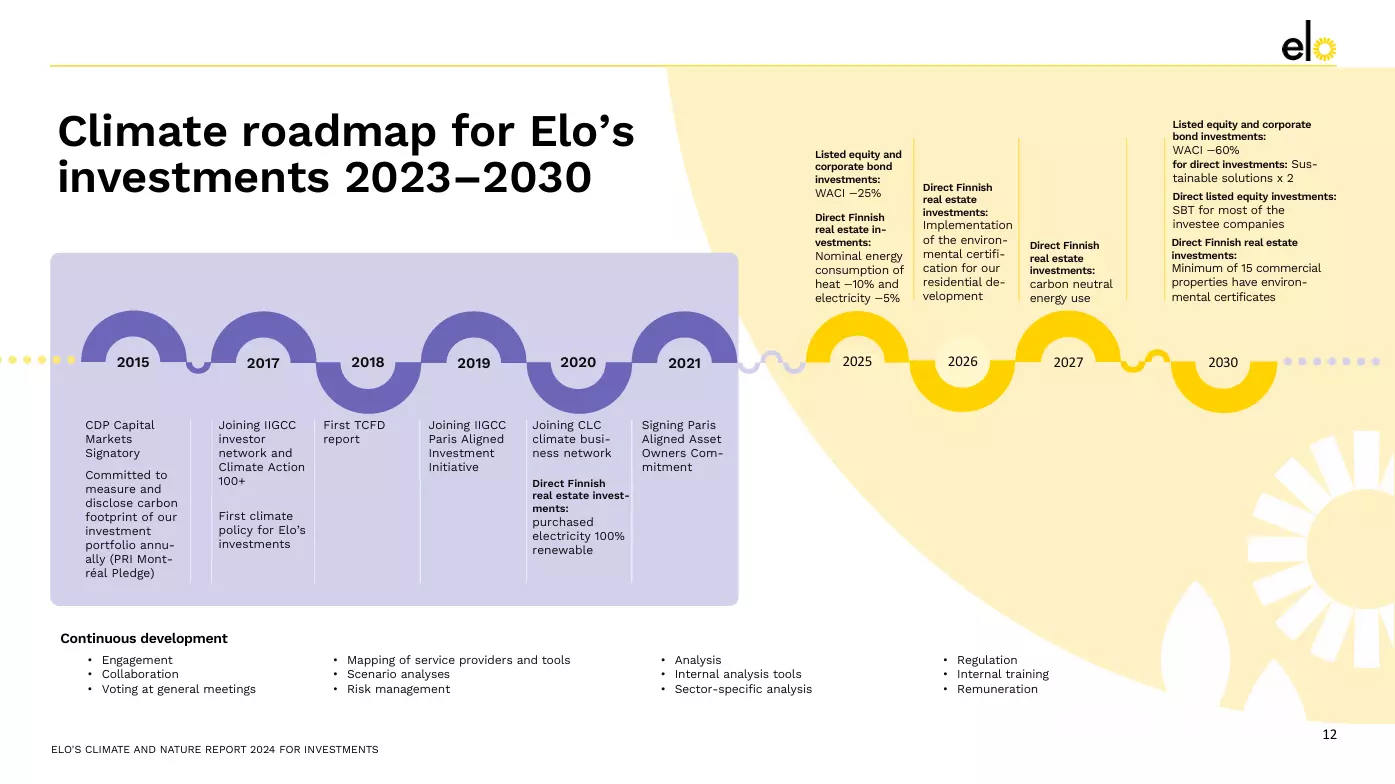

Climate targets for investments

Elo is committed to responsible investing and combating climate change. Below are the concrete climate targets that guide our investment activities toward a low-carbon and sustainable future.

- We will reduce the carbon intensity of listed equity and corporate bond investments by 25% by 2025 and 60% by 2030.

- In direct investments, we are doubling our investments in sustainable solutions.

- The majority of our direct equity investments have a science-based emission reduction target and plan.

- We take climate change into account as part of our annual risk assessment and allocation work.

- We will specify our measures regarding investments in fossil energy production.

By 2027, we will achieve carbon neutrality in the energy use of buildings we directly own in Finland

Climate roadmap for Elo's investments

Reports

Elo´s principles of responsible investing (PDF)

Elo´s principles of responsible investing (PDF)

Principles of Environmental Responsibility at Elo 2025 (PDF)

Principles of Environmental Responsibility at Elo 2025 (PDF)

Elo’s climate policy 2023-2030 (PDF)

Elo’s climate policy 2023-2030 (PDF)

Climate and Nature Report 2024 for investments (TCFD+TNFD)

Climate and Nature Report 2024 for investments (TCFD+TNFD)

Biodiversity in investment activities (PDF)

Biodiversity in investment activities (PDF)

Elo´s climate strategy 2020–2025 presentation (PDF)

Elo´s climate strategy 2020–2025 presentation (PDF)

Engagement Policy of Elo’s investments

Engagement Policy of Elo’s investments

PRI Reports

PRI Assessment Report 2025

PRI Assessment Report 2025

Public Transparency Report 2025 (pdf)

Public Transparency Report 2025 (pdf)

Public Transparency Report 2024 (pdf)

Public Transparency Report 2024 (pdf)

Public Transparency Report 2023 (pdf)

Public Transparency Report 2023 (pdf)

Public Transparency Report 2021 (pdf)

Public Transparency Report 2021 (pdf)

Public Transparency Report 2020 (pdf)

Public Transparency Report 2020 (pdf)

Public Transparency Report 2019 (pdf)

Public Transparency Report 2019 (pdf)

Public Transparency Report 2018 (pdf)

Public Transparency Report 2018 (pdf)

Public Transparency Report 2017 (pdf)

Public Transparency Report 2017 (pdf)

Public Transparency Report 2016 (pdf)

Public Transparency Report 2016 (pdf)